Foreseeing

big shifts

ECONOMIST. STRATEGIST.

GLOBAL Forecaster.

What Nouriel got right

Voicing the economics of risk, power, and disruption with uncommon clarity.

Nouriel Roubini is a world-renowned economist and strategist, known for his prescient warnings of the 2008 Global Financial Crisis and for shaping debate on the world’s most urgent macroeconomic risks.

He is Chairman and CEO of Roubini Macro Associates, LLC, a New York–based consultancy providing strategic macroeconomic analysis. He also serves as Senior Economic Strategist to Hudson Bay Capital, Chairman of the Advisory Board of the Brevan Howard Macro Venture Fund, Chief Economist and Portfolio Manager at Atlas Capital Team, and is Professor Emeritus of Economics at NYU’s Stern School of Business.

An expert of economic and financial crisis having studied them as an academic researcher, policy maker, economic consultant, public speaker and intellectual, Roubini delivers unmatched insight on Geopolitical Risk & Strategy, Macro & Market Outlook, Climate and Sustainability Challenges, and New Technological Innovations. The intersection of all to lends understanding, strategies and clarity for successfully navigating the Global Economic Future.

SPEAKING ON WHAT MATTERS

Dr. Roubini delivers keynote addresses and participates in high-profile panels worldwide, sharing insights on global economic trends, trade policies, and market dynamics.

Trusted. Quoted. Heard worldwide.

ARTICLE ARCHIVE

BookShelf

A collection of sharp, forward-looking works on economics, policy, and crisis, each written to decode complex risks before they break into public view.

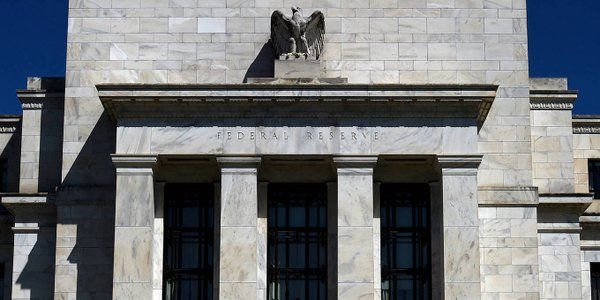

My new op-ed: Kevin Warsh Is in for a Rude Awakening by Nouriel Roubini @ProSyn

For years, Kevin Warsh, Donald Trump’s nominee to serve as the next chair of the US Federal Reserve, has been staking out policy positions that would almost certainly backfire

Kevin Warsh Is in for a Rude Awakening

Nouriel Roubini doubts the next Federal Reserve chair’s theoretical views will survive an encounter with real-world markets.

prosyn.org

Strategic Signal Changed – Please refer to the note for details in MACRO FILES

Site | The Boom Bust

www.theboombust.com

to top